The term “routine maintenance” refers to costs incurred on a unit of tangible property or a building that are deemed not to improve that unit of property or building. To make what is variance analysis 2021 definition examples andadvantages these elections, you should attach a statement for each election to your timely filed original federal tax return including any extension for the taxable year in which the amounts subject to the election are paid. Each statement should include your name, address, Taxpayer Identification Number, and a statement describing the election. For some elections, you will need to include a description of the property to which the election is applied.

However, the machine falls into taxable benefit territory when it’s used too much for personal reasons. Feel free to blame me the next time you need to tell your employees to stop printing their children’s birthday party invitations at work. Small businesses most often use the phrase when talking about employee benefits. The IRS says you can leave off small gifts and perks from taxable employee compensation since it’s “unreasonable or administratively impracticable” to account for.

The de minimis and routine maintenance safe harbors

Many benefits provided by employers are taxable as income to the employees, but a de minimis benefit is not. From a tax standpoint, a de minimis benefit is a small amount of employee compensation, and Internal Revenue Code section 132(a)(4) states that these small amounts are not subject to taxation. It offers advantages such as reduced administrative burden, simplified tax calculations, and potential tax savings for investors engaged in smaller real estate deals.

Taxes are no de minimis matter

If the ratio computed is within 0.5% of the HAR, the taxpayer can continue to use its HAR for another qualifying period of five years; however, if the taxpayer fails the retest, it will need to start a new three-year testing period. Nothing in the final tangibles regulations under section 263(a) changes the treatment of any amount that is specifically provided for under any provision of the IRC or the Treasury regulations other than section 162(a) or section 212. For example, the final tangibles regulations do not eliminate the requirements of section 263A, which generally provides that you must capitalize the direct and allocable indirect costs of producing real or tangible personal property and acquiring property for resale.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. We follow strict ethical journalism practices, which includes presenting unbiased information and citing how to choose a fiscal year reliable, attributed resources.

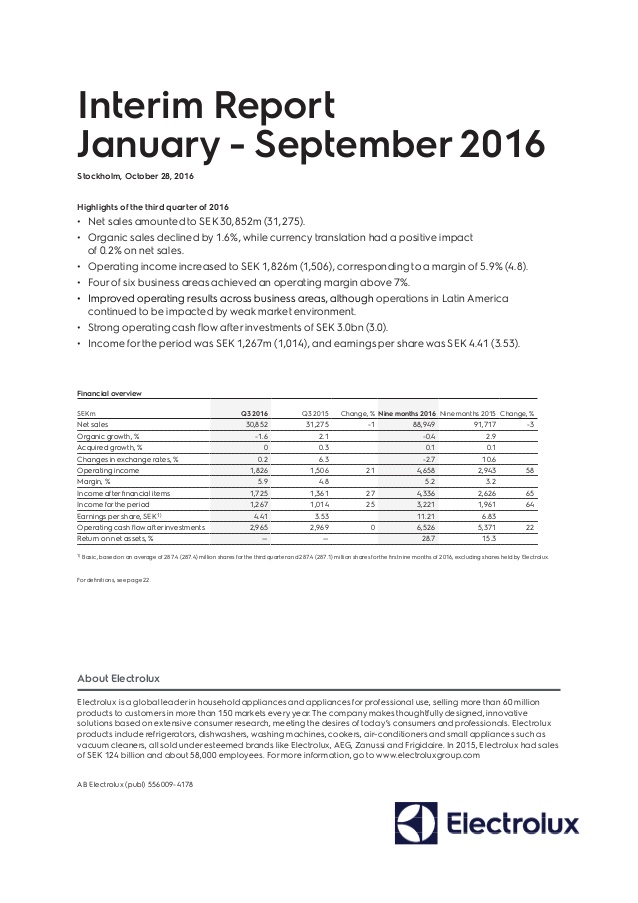

These regulations apply to corporations, S corporations, partnerships, LLCs, and individuals filing a Form 1040 or 1040-SR with Schedule C, E, or F. The final tangibles regulations affect you if you incur amounts to acquire, produce or improve tangible real or personal property in carrying on your trades or businesses. The rules are most significant for those that regularly incur large capital expenditures, e.g., electric utilities, telecommunications companies, and businesses with substantial real estate holdings. The final tangibles regulations are effective for taxable years beginning on or after Jan. 1, 2014. There are many examples in the final tangibles regulations to illustrate the application of these new provisions. If this amount is higher than the purchase price of the discount bond, the purchased bond is subject to the ordinary income tax rate.

- Many benefits provided by employers are taxable as income to the employees, but a de minimis benefit is not.

- The rule states that a discount that is less than a quarter-point per full year between its time of acquisition and its maturity is too small to be considered a market discount for tax purposes.

- See Safe harbor election for small taxpayers, Safe harbor for routine maintenance, and Election to capitalize repair and maintenance costs.

- Unlike most fringe benefits, they’re not considered employee compensation and aren’t subject to federal taxes.

When and how do you make an election provided under the final tangibles regulations?

Since it’s an annual thing that costs the business entity relatively little money, the gift isn’t construed as taxable compensation to the employee. These business credit cards that offer a convenient and efficient way to separate personal and business expenses, simplifying accounting and tax reporting. Fringe benefits are the ancillary extras that you offer employees aside from wages or salary.

A process of experimentation: Production expenses for the R&D tax credit

For the Year Placed in Service – This rule, only for non-building property, is triggered at the time you initially placed the unit of property into service. If they are taxable, they should be included in wages on Form W-2 and subject to income tax withholding. If the employees are covered for Social Security and Medicare, the value of the benefits are also subject to withholding for these taxes. The applicability of the De Minimis Tax Rule may vary depending on the tax jurisdiction and specific regulations.

Expenses incurred related to scheduled maintenance shortly after the unit of property or building structure or system is purchased and/or placed into service would thus not qualify. Sec. 1.263(a)-3(i)(6) provides a number of examples that clarify the application of the safe harbor for routine maintenance. Example 1 provides a great illustration of how certain costs required by the manufacturer or a governing agency can be expensed as long as the item is a recurring one, does not improve the unit of property, accounts receivable job description and is within the class life of that unit of property.

The rule states that a discount that is less than a quarter-point per full year between its time of acquisition and its maturity is too small to be considered a market discount for tax purposes. Instead, the accretion from the purchase price to the par value should be treated as a capital gain, if it is held for more than one year. Generally, you receive automatic consent to change a method of accounting by completing and filing Form 3115, Application for Change in Accounting Method (Rev. Dec. 2015), and including it with your timely filed original federal tax return for the year of change.